The Indian Union minister Mr. Ravi Shankar Prasad, unveiled guidelines for electronics manufacturing schemes, earlier this month. These schemes were aimed at strengthening India’s Make in India program and further supporting manufacturing in India.

Three schemes were announced with a total outlay of INR 50,000 crores (~USD 7bn). This article covers two schemes as listed below, applicable to production units.

1. Production Linked Incentive (PLI) scheme.

2. Scheme for Promotion and Manufacturing of Electronic Components and Semi-Conductors (SPECs).

Background

Electronics manufacturing is considered to be the backbone of manufacturing as it permeates all sectors and has strategic importance. The last 4 years has seen electronics manufacturing in India grow rapidly at CAGR of 25%. Further as per the industry estimates, electronics manufacturing sector in India, suffers from a disability of around 8.5% to 11%. This is on account of lack of adequate infrastructure, domestic supply chain and logistics, high cost of finance, inadequate availability of quality power, limited design capabilities and focus on R&D by the industry and inadequacies in skill development. Given the limited relief expected for electronics manufacturing sector under other schemes, there is a need for a mechanism to compensate for the manufacturing disabilities vis-à-vis other major manufacturing economies. Therefore, in order to boost investment in electronics such incentives are being given by the government of India.

Before we understand the schemes, it would be good to detail the category of products to which the schemes are applicable. These categories are:

a. Mobile phones.

b. Specific electronic components (SEC) which include:

• SMT components.

• Discrete semiconductor devices including transistors, diodes, thyristors, etc.

• Passive components including resistors, capacitors, etc. for electronic applications.

• Printed Circuit Boards (PCB), PCB laminates, prepregs, photopolymer films, PCB printing inks.

• Sensors, transducers, actuators, crystals for electronic applications

• System in Package (SIP).

• Micro / Nano-electronic components such as Micro Electromechanical Systems (MEMS) and Nano Electromechanical Systems (NEMS).

• Assembly, Testing, Marking and Packaging (ATMP) units.

Details of The Scheme

1. Production Linked Incentive scheme (PLI)

If you manufacture any of the above products (a & b), the scheme may extend an incentive of 4% to 6% on incremental sales (over base year) of goods manufactured in India for a period of 5 years subsequent to base year.

Eligibility shall be subject to thresholds of incremental investment and incremental sales of manufactured goods.

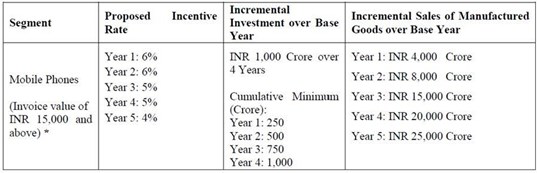

Eligibility threshold for companies manufacturing mobile phones above INR 15,000 (Exhibit A below)

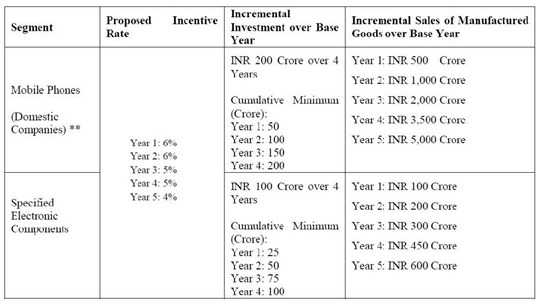

Eligibility threshold for companies making mobile phones below INR 15,000 and SEC being manufactured by both domestic/ non domestic companies (Exhibit below)

Therefore, foreign companies (setting up Indian entities and manufacturing in India) shall be given incentives if they are manufacturing mobile phones (above INR 15,000) and for all SEC without any minimum monetary limit. Domestic companies (defined as companies owned more than 50% by Indian residents) will be provided incentives on mobile phones (irrespective of value) and on all SEC. The idea here seems to attract foreign investment in mobile phones of higher value and all SEC.

Say, you are a manufacturing company which manufactures SEC products. The government requires you to invest 100 crore over the next 4 years in your business and meet the sales threshold of INR crores 100, 200, 300,450 and 600 during year 1, 2, 3, 4 and 5. Basis the above, there would be an incentive on sales for each year amounting to minimum INR crores 6,6,5,7.5 and 6 (provided targets are met); therefore minimum accumulating INR 30.5 crores under the PLI scheme. Applications are required to be made by eligible applicants. Within 15 days after prima facie examination, letter of acknowledgement will be issued and letter of approval will be sought from competent authority. Baseline and thresholds will then be approved for each eligible applicant and disbursements shall be made on successful approvals/ confirmations each year. The scheme is open for 4 months initially.

2. Scheme for Promotion and Manufacturing of Electronic Components and Semi-Conductors (SPECs)

An incentive of 25% of capital expenditure on reimbursement basis is offered. This covers electronic components, semiconductor/ display fabrication units, ATMP units, specialized sub-assemblies and capital goods for manufacture of aforesaid goods. The eligible investment shall be in new and expansion of Plant & Machinery, associated utilities and technology including R&D.

Applications are open for three years and investments made within 5 years from date of acknowledgement will be eligible for receiving incentives.

The aim of this scheme is to strengthen the manufacturing ecosystem for electronic components and semi-conductors.

This document was authored by Paramnoor Singh.

Mr. Singh is the partner at R. Arora and Associates, an India based Chartered accountancy practice, head quartered at New Delhi with offices across India.

He can be reached at: paramnoor.singh@r-arora.com