The Finance Act, 2020 has introduced several modifications in the Indian taxation. AKGVG & Associates has summarized the amendments brought about in TCS provisions and TDS on dividend by the Finance Act, 2020 for ease of understanding.

W.e.f. 1st October 2020, all sellers (with sales exceeding Rs. 10 crores during the FY 2019-20) need to collect TCS @ 0.1% (0.075% for FY 2020-21 & 1% for non-PAN buyers) of the sales consideration (against sale of goods) received in excess of Rs. 50 lacs from a buyer during the financial year.

Exceptions to the above provisions:

W.e.f. 1st October 2020, the following TCS provisions have been introduced on foreign remittances on which TDS has not been deducted:

Exceptions to the provisions as stated in point a) above:

In this regard, the Central Board of Direct Taxes (‘CBDT’) issued Notification No. 54/2020 dated 24.07.2020, there by amending Rule 31AA, Rule 37BC, Rule 37CA, Rule 37-I of the Income Tax Rules, 1962 and Form No. 27EQ to incorporate the changes in relation to the aforementioned provision.

With the advent of Financial Year 2020-21, dividend taxation in India has completely gone upside-down. The new provisions have again asked the recipient of dividend to pay taxes instead of the company who was distributing the dividends.

The changes in the Income tax law which brought the above change are as under:

Another major change in addition to the above is re-introduction of Tax Deducted at Source (TDS) or Withholding tax (WHT) on Dividends.

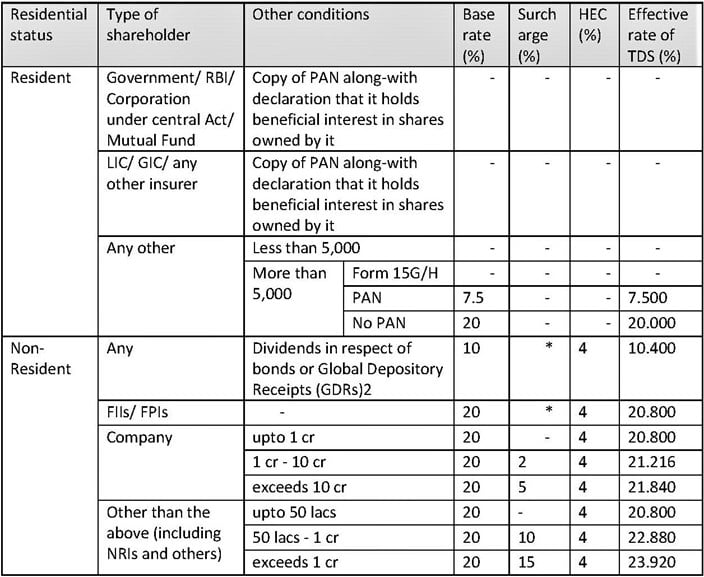

With the closure of FY 2019-20 approaching, companies are in the process of distributing dividends. However, they are struggling with the above changes as the rate of TDS varies from shareholder to shareholder depending on several factors like residential status, type of shareholder, quantum of dividend, etc. In this regard, a summary of the rates of TDS (as provided under the Income tax provisions) along-with the various conditions to be satisfied are summarized in the below table:

*The rates of surcharge are applicable on all the non-residents (depending on their income) irrespective of the type of assessee. Accordingly, rate of surcharge for FIIs/ FPIs and dividends in respect of GDRs will be dependent on the type of shareholder i.e. company or non-company.

Basis the above one may note that the rates of TDS will be varying from 0% to 23.92%.

However, the above-mentioned rates are based on the provisions of the Income tax Act only i.e. before considering any benefit available under the Double Taxation Avoidance Agreement (DTAA or tax treaty) of the country of residence of the shareholder. Where the shareholder is entitled and is willing to claim tax treaty benefits, it will be required to submit the following documents with the company, before it distributes the dividend:

After obtaining and validating the above documents, the companies need to analyze the provisions of the India’s DTAA with the country of residence of the shareholder along-with the recently introduced provisions of Multi-lateral Instrument (MLI) to conclude the final rate of TDS. However, even after the above TDS, the non-resident shareholder will not be spared. In case TDS is computed in accordance with the DTAA provisions, the non-resident shareholder will also be required to file its income tax return in India as per the provisions of the Indian Income tax Act.

In addition to the above compliance burden, every such company is also required to file a separate Form 15CA/CB for each of its shareholders whom its paying the dividend if the shareholder is a non-resident.

Posted by: Vineet Gupta

Designation: Managing Partner

Organization: AKGVG & Associates

Mobile no: +91-9811118031

E-mail: vineet.gupta@akgvg.com