In these unprecedented times, we are doing our best to keep business interruption to a minimum and support client wherever we can. We are delighted to state that we have signed up new clients in this period which include;

• Ministry of Labor

• Ministry of Energy

• General of Commission for the Guardianship of Trust Funds for Minors and their counterparts

• Saudi office of a global Telecommunications company

• Saudi office of an International battery manufacturing company

New legislations and relevant developments in KSA

Saudi Arabia is suspending the cost of living allowance and increasing the value-added tax VAT from 5% to 15% from 1 July 2020, with some transitional reliefs, as part of measures to address the impact of the COVID-19 crisis.

As a result, businesses impacted by the increased VAT rate will face a challenging decision as to whether to pass on the additional VAT to their customers or absorb this cost to some degree. Many businesses may have no choice but to pass on the additional cost to customers.

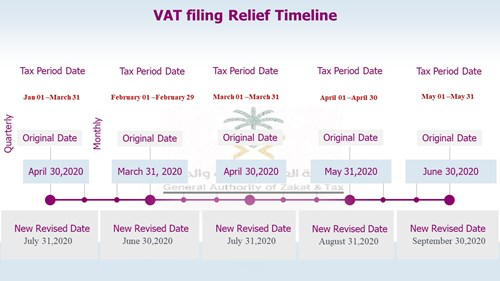

VAT filing relief

The tax filing relief provided by GAZT will come to an end on 30 June 2020.