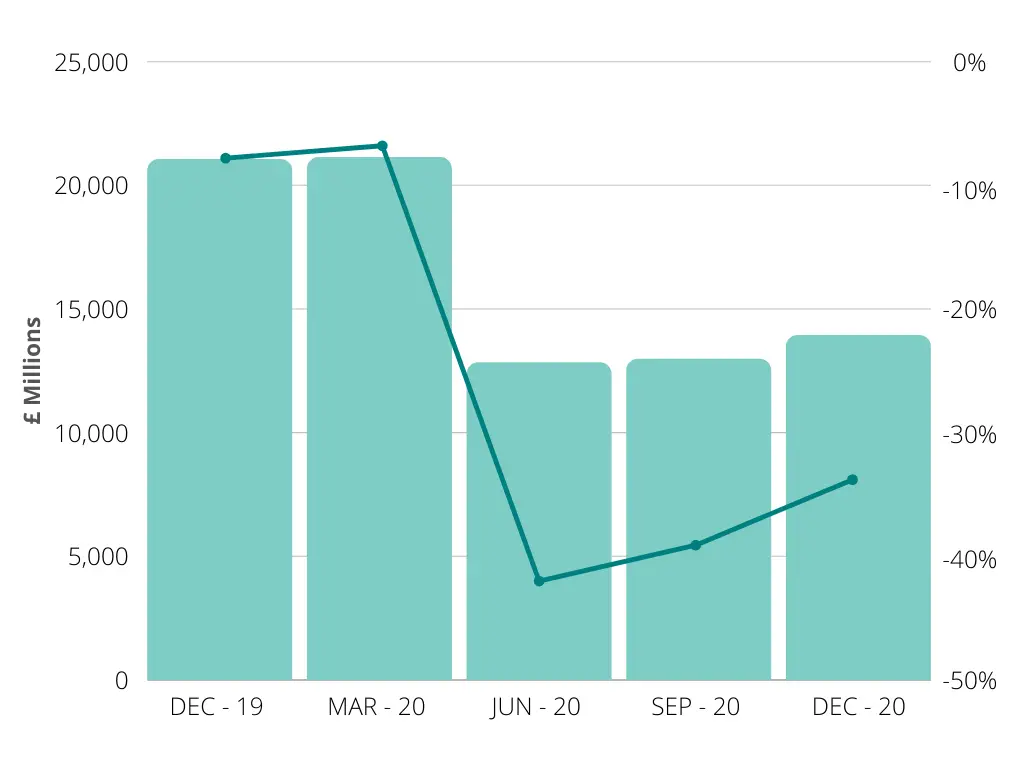

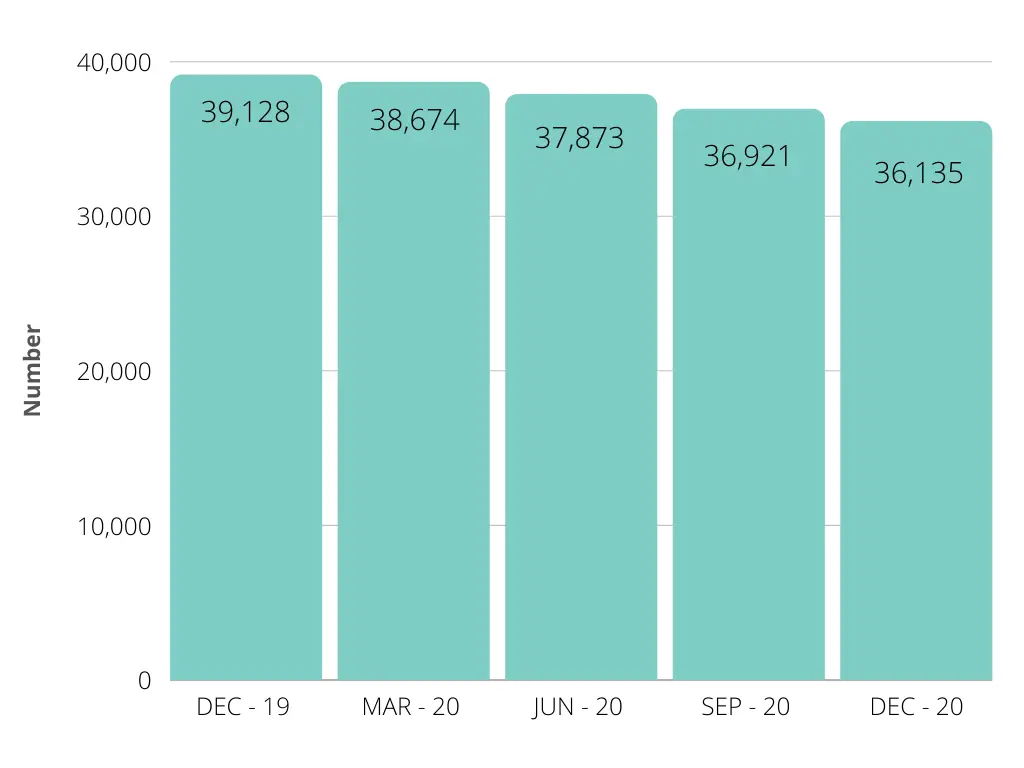

In general, the data shows that, in the first half of 2020, there was a big decline in the level of facilities or drawdown. Within the context of the COVID-19 pandemic, this pattern is unsurprising as lockdown meant that many businesses that use working capital facilities such as invoice factoring discounting and stock finance saw the availability of these facilities reduce in line with activity levels. In the second half of the year, we have seen this start to bounce back again as the successive lockdowns ease and those businesses that have been forced to close re-open. However, the number of customers and facilities is still well below pre- COVID levels, and it will be interesting to see how this changes in the first half of 2021 (and beyond) as things return further to ‘normal’.

Whilst the reduction in ABL drawdown is understandable, we have also seen a reduction in the number of businesses utilising ABL facilities, when we might have expected greater reliance on ABL funding, so how are businesses managing cash? There is the possibility that some businesses have replaced these facilities with CBILS and other Government support during the last 12 months, as the popularity of these schemes was significant. Alternatively, something that we have observed is that many businesses have managed to trade well through the pandemic by tightening up on their trading and working capital procedures and cutting out operational and financial ‘fat’. Consequently, in certain sectors, trading has become more efficient, profitability has gone up, which has converted to cash. This is illustrated, perhaps, by a reduction in debtor days among those businesses. For factoring and invoice discounting clients, average debtor days are down from 51 to 47 over the course of the year. While those numbers don’t seem massive, an 8% improvement in debtor days frees up a lot of cash within businesses to invest in maintaining operations (in times of uncertainty) or in growth. So it could go some way to explaining the reduction in the use of facilities.

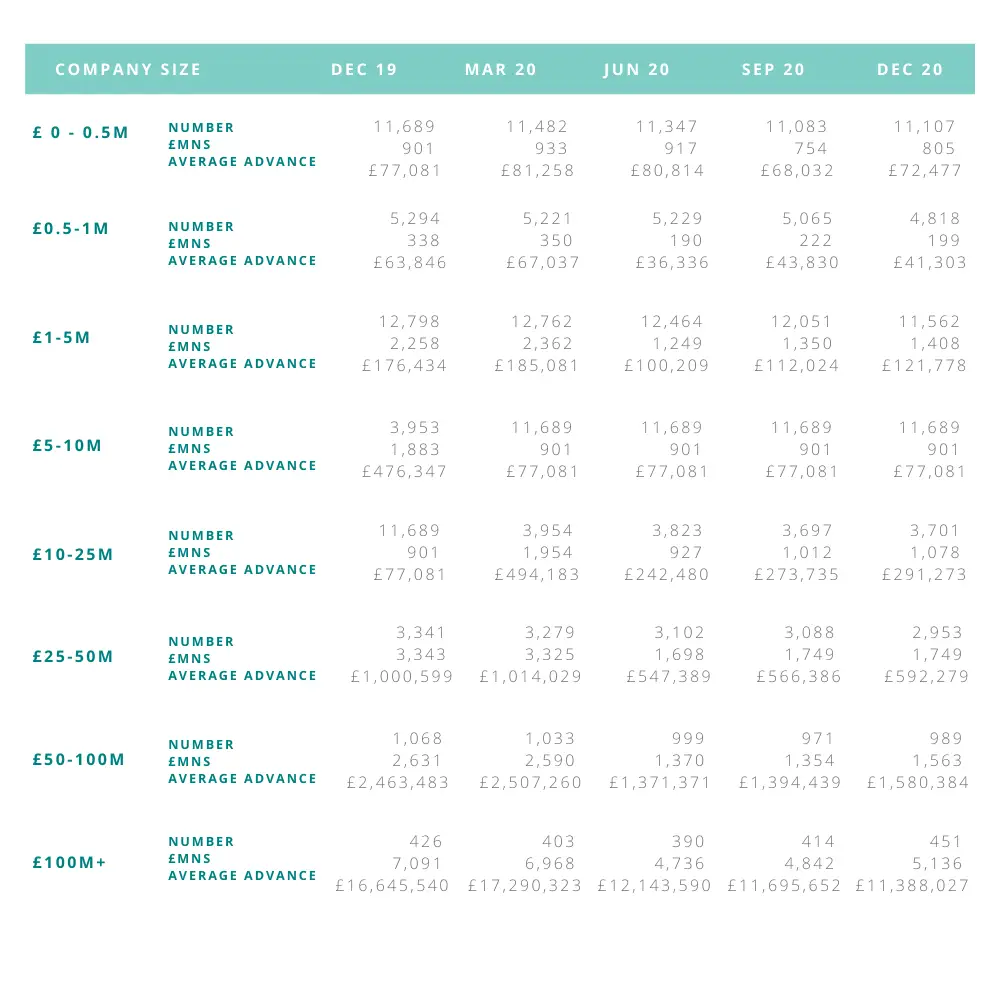

However, if we look at the overall reduction in numbers and the slight bounce back in facilities toward the end of the year alongside the data regarding the size of businesses, this may highlight something that many of us are conscious of as we come out of the pandemic – the increasing gap between the ‘haves’ and the ‘have nots’. If we look at the level of borrowing on bounce back loans, this is much higher overall than the borrowing for CBILS and CLBILS for larger corporates. Additionally, many of those borrowing on the bounce-back scheme tend to be more likely to struggle with repayment in the future. This is also reflective of the numbers utilising ABL facilities (shown below). The number of £0-500k turnover businesses using ABL facilities is disproportionately higher compared to £100m+ turnover businesses. Since COVID, there has been a 30% reduction in the average advance, compared to only a 5% reduction for small businesses. SMEs are the ‘backbone’ of the country’s businesses, providing high employment levels –but they would appear to be the most financially stressed coming out of COVID, and with limited headroom and no room to further tighten working capital, how will they support economic growth?

This dynamic of overall reduced customer number and borrowing volumes (if it continues) creates an interesting challenge for lenders. Ultimately, with reduced numbers, there are fewer clients to chase. Therefore, as a sector, ABL may be about to go through a bit of disruption, and we may see lenders chasing business more and getting more aggressive around pricing. The decision to be made is whether they continue to chase the right size of business or whether they chase volumes at the expense of price against a backdrop of higher default risk. It will be interesting to see what happens.

As we come out of lockdown and businesses look toward the future post-COVID-19, owners will need to invest in growth, and for many, this will mean accessing funding via ABL facilities. Therefore, we would expect to see a continued bounce-back of the volume in both clients and facilities over the next 12 months. However, there may be a higher risk for some sectors and pockets of industries, and both businesses and lenders need to consider this in their funding strategies going forward. Nevertheless, ABL remains a viable and preferable funding option for businesses across the UK. In many cases, you may be able to access more of a facility than you via a standard cash flow lend – so, if you haven’t considered it before, now may be the time.

If you are looking to access funding or are unsure of whether your business’s funding needs are suitable for ABL, please contact Phil Sharpe on the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.